HOME EQUITY = HOME IMPROVEMENTS

Why a home equity loan?

CAFCU's home equity loans offer you a low-rate borrowing opportunity by harnessing the value in your home. Equity is the difference between your home's current market value and the balance owed on your mortgage. A home equity loan lets you borrow against that equity. Here's a breakdown of the benefits of working with CAFCU on your home equity loan:

- Low rates

- $0 application fees

- No closing costs

- Quick, no-hassle approvals

- Personalized loan terms

What can I use a home equity loan for?

A home equity loan can help you pay for large expenses such as:

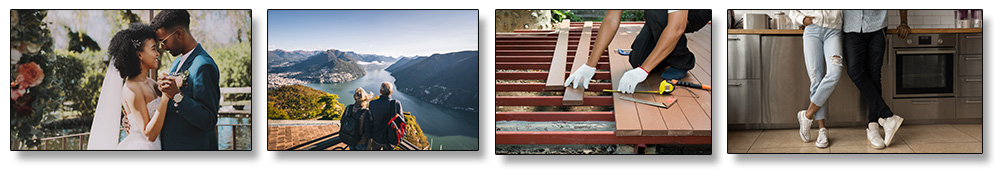

Planning a wedding | Taking a dream vacation | Making home improvements | Purchasing new appliances |

Building a backyard oasis | Paying college expenses | Paying off high-interest debt | Making long-term investments |

At CAFCU, we offer two home equity loan options to suit your needs:

Fixed-Rate Home Equity LoansWith a Fixed-Rate Home Equity Loan, you can borrow a fixed amount of money that is repaid over a set period of time. Our fixed-rate home equity loan can have flexible terms to better fit your financial situation, with the option to pay by automatic payroll allocation.

Home Equity Lines of Credit (HELOC)Our HELOC gives you access to the cash you need, when you need it. HELOCs have a variable interest rate. Once your line of credit is approved, you can draw on it for up to 10 years using free line of credit checks for convenient access to your funds. You only make payments on the amount you've used. You can also opt to include overdraft protection from your CAFCU Checking Account and repay the loan directly from your paycheck with payroll allocation.

Home Equity FAQ

Have questions about your home equity options? Our lending specialists can help you take advantage of your home equity today! Contact us at 1-800-359-1939, option 2, to have your questions answered.