Earn 5X bonus rewards with a new CAFCU Visa credit card

For a limited time when you open a new CAFCU credit card, you can earn 5X bonus rewards (up to 25,000 points) when you spend on gas, groceries, and utilities for the first six months after opening a card!**

Get your questions answered about CAFCU's low-rate credit card by choosing from the topics below.

What is a low-rate credit card?

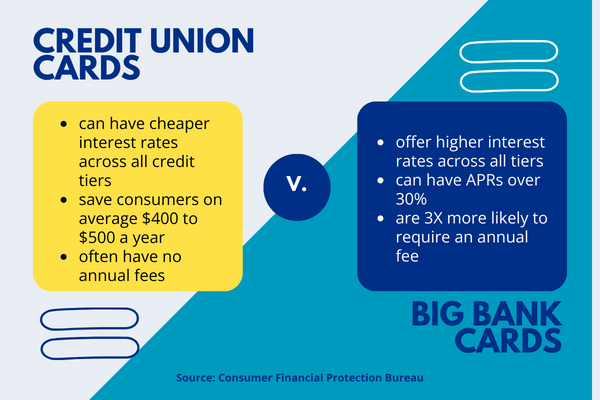

Credit card interest rates are skyrocketing, with some major credit cards having an annual percentage rate of more than 30%.

According to the

Consumer Financial Protection Bureau (CFPB), "small banks and credit unions tended to offer cheaper interest rates than the largest 25 credit card companies across all credit score tiers."

One of CAFCU's best kept secrets is that as a member-owned, not-for-profit credit union, we keep our Visa credit card rates well below the industry average to help empower our members.

What are the benefits of a CAFCU credit card?

Our members can enjoy the following benefits with their CAFCU Visa credit card:

- NO balance transfer fees.

- NO annual fees.

- NO minimum finance charges.

- Lower-than-average interest rates.

- uChoose Rewards® or interest rebate options

- Convenient, self-service security features in our digital banking app.

Compare our credit card options

How to get a CAFCU Visa credit card

Here's how to get started:

- Click APPLY NOW and submit your online application.

- Choose the card you are interested in under “Type of Loan" (Platinum Advantage, Advantage, or Share-Secured Visa).

- A lending expert will reach out during normal business hours to match you with the best card option for your background and needs.

- If approved, you’ll receive your new Visa credit card within 7 to 10 business days.

- After your card is active, remember to register with uChoose Rewards® to earn shopping rewards OR opt into the Interest Rebate program.

Where can I find CAFCU's credit card rates?

To view our current rates, visit our

Rates page and scroll down to Visa Credit Card Rates.

Can I get a CAFCU Visa if I'm not a member?

Not a member yet? No problem!

Check out our join page to learn more about whether you qualify to join our award winning credit union. Once you're ready to start your application, you will be prompted to start your membership.

Can I transfer balances to a CAFCU Visa?

How do I get my rewards?

Easy! Once your CAFCU Visa credit card is active, you can register for uChoose Rewards

® at

cafcu.org/uchoose.

Added CAFCU Visa credit card perks

Our Visa credit cards offer additional services to our cardholders. The enhancements available vary depending on the type of credit card:

- Auto Rental Collision Damage Waiver – The Auto Rental Collision Damage Waiver provides insurance coverage against theft or damage on rented vehicles.

- Travel Accident Insurance – The Travel Accident Insurance provides accidental death and dismemberment coverage for the cardholder and eligible family.

- Travel and Emergency Assistance – This 24-hour referral service will aid cardholders and their families in locating emergency assistance worldwide.

- Warranty Manager Service – This service provides two separate benefits to cardholders: Extended Warranty Protection and Warranty Registration Service.

For general information on our Visa credit card enhancements, please contact our Member Center at 1-800-359-1939, Monday through Friday from 7 a.m. to 7 p.m. CST.

*APR = Annual Percentage Rate. The Annual Percentage Rate is determined by adding 6.65-14.65 for Platinum Cards and 8.65-16.65 for Advantage Cards to the Prime Rate. The Prime Rate used to determine your APR is the rate published in the "Money Rates" table of The Wall Street Journal on the last Friday of each month; if the last Friday is a Federal Holiday the following day's Prime Rate will be used and is effective the first day of the following month. Rates may change after the account is opened.

uChoose Rewards is a registered trademark of Fiserv, Inc. Apple Pay is a trademark of Apple Inc. Google Pay is a trademark of Google LLC. Samsung Pay is a trademark of Samsung Electronics Co., LTD.

**Applicants must sign up for a Visa® Platinum Advantage, Visa® Advantage, or Share Secured Visa® from Corporate America Family Credit Union (CAFCU) during the promotional period. 5X bonus points can be earned for up to six months on CAFCU uChoose Rewards® Visa® credit cards opened starting January 1, 2024 for a limited time on qualifying purchases made at select gas stations, grocery stores, and utility bills. 5X points equal five (5) points per $1 purchased. Limit 25,000 points, which is equal to a cash redemption value of $250.00. After the six-month promotional period expires, members will earn the standard one (1) point per dollar spent on all eligible purchases. This offer applies only to new credit cards opened during the promotional period; existing Visa credit cards are not eligible. Activation required. See the uChoose Rewards website at uchooserewards.com for full program terms and conditions. Restrictions may apply. Gas, grocery, and utility categories are based on each individual merchant’s classification, so purchases made at similar merchants may be classified differently and, as such, may not qualify for bonus points. Gas purchases at warehouse and membership clubs, grocery stores, car washes, auto repair stores, and superstores that sell gasoline may not be coded as gas stations and may not be eligible for this offer. Grocery purchases at warehouse and membership clubs, convenience stores, and superstores that sell groceries may not be coded as grocery stores and may not be eligible for this offer. Cash advances, transfers, ATM transactions or PIN transactions do not qualify. CAFCU reserves the right to end the promotional offering at any time. Contact CAFCU for complete details or visit https://www.cafcu.org/Visa. uChoose Rewards is a registered trademark of Fiserv, Inc.